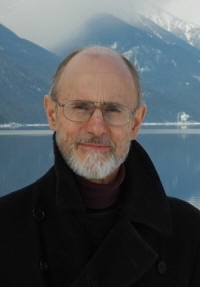

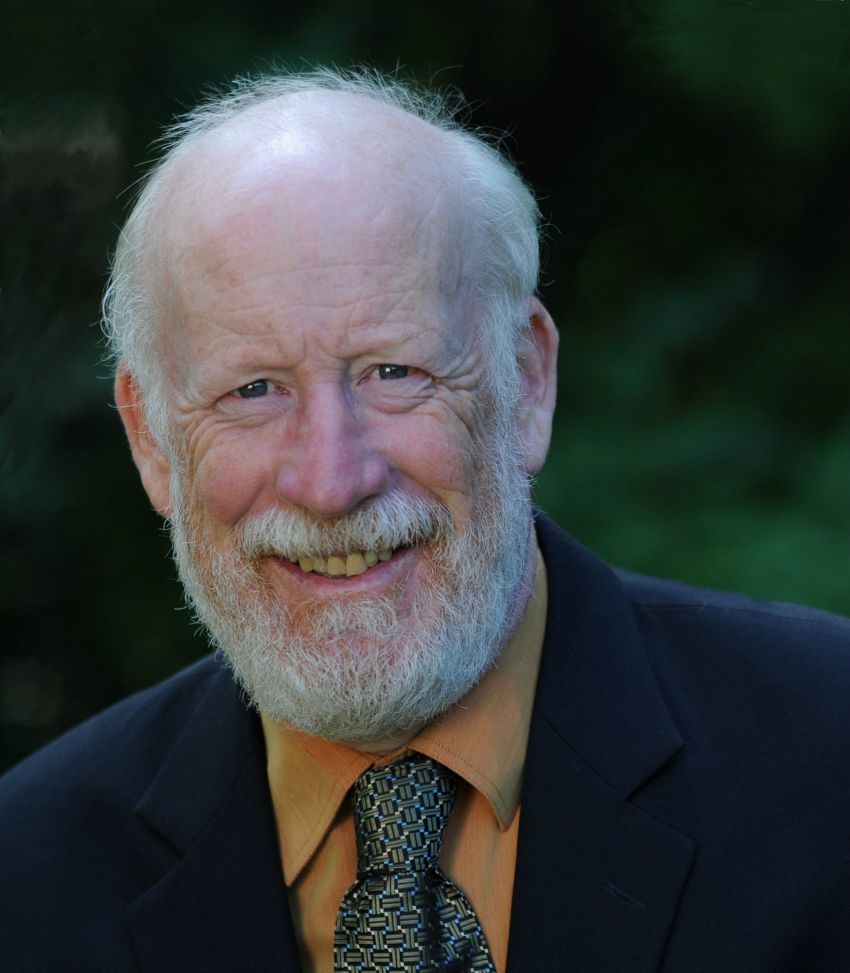

OP/ED: MP slams new US tax laws that apply to some Canadians

BC Southern Interior MP Alex Atamanenko is outraged at the proposed United States (US) tax crackdown recently announced by the American government.

By law, all individuals holding US citizenship are required to file annual income tax returns with the Internal Revenue Service (IRS). In addition, the new US Foreign Account Tax Compliance Act (FATCA) obliges Canadian financial institutions starting in 2013 to report to the IRS all accounts held by US citizens. “There are hundreds of thousands of Canadian citizens who have dual citizenship who will be affected by these draconian measures,” said Atamanenko. “It is absolutely ridiculous and absurd that a Canadian citizen who pays taxes in Canada has to file with the IRS or risk heavy penalties. “What right does a foreign government have to force a local credit union to disclose all accounts, including RRSPs, TFSAs and chequing and savings accounts?” he said. “This is a complete affront to our Canadian sovereignty. I have written Finance Minister Flaherty, urging him to work out an arrangement with the American authorities that does not place a further unnecessary burden on Canadian citizens or on our financial institutions. Law abiding citizens should not be put in the same category as US citizens seeking tax havens in foreign countries.” For those US citizens and green card holders who have not been filing their US tax forms, the IRS has issued a limited amnesty to report their Canadian bank accounts by August 31. The following is a letter issued by Atamanenko: The Honourable Jim Flaherty Minister of Finance House of Commons Ottawa ON K1A 0A6 Dear Minister, I write to express my concern about the US Foreign Account Compliance Act (FATCA). As you are aware, starting in 2013 our Canadian financial institutions will be required by US law to report to the Internal Revenue Service (IRS) all accounts held by US citizens in Canada. Canadian citizens who happen to have dual citizenship, or Americans with landed immigrant status will be required by US law to disclose all forms of Canadian bank accounts, including RRSPs, RRIFs, TFSAs and chequing and saving accounts. It is my understanding that the US tax rules eliminate the benefit of taking out TFSAs and RESPs, and that long time residents’ savings in mutual funds may be subject to US tax. We currently have a reciprocal tax agreement with the US, and yet American citizens who live and work in Canada still have to file tax returns with the IRS and now will be faced with penalties if they choose not to do so. The FATCA is a further affront to Canadians and also places a burden on our financial institutions. On behalf of all those adversely affected by this draconian US policy, I respectfully request that our federal government advise US authorities that this policy is not acceptable, and make every effort to work out an arrangement that would not place a further unnecessary burden on Canadian citizens or on our financial institutions. Those who live, work and pay taxes in Canada should not be subject to the same rules as US citizens seeking tax havens in foreign countries. Sincerely, Alex Atamanenko, MP BC Southern Interior

Comments