Council to pass tax bylaw with minimal increase

Despite a residential tax increase this year, Castlegar homeowners will likely be paying less property tax in 2012 than they did in 2010.

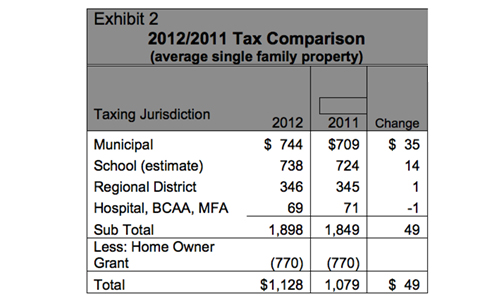

In a report presented to city council at its regular meeting Monday night, city director of financial services Andre Buss told council that modest increases have been offset by an increase in the homeowner grant that should see propety taxes remain lower than they were in 2010 (depending, of course, on increases imposed by other jurisdictions for which the city must collect, such as the school district).

“City of Castlegar 2012 taxes and utility charges on a representative residential property will remain very competitive when compared to the taxes and charges that other municipalities in our area levied in 2011.,” said Buss, pointing out that of nine local communities, Castlegar has almost the lowest municipal tax rate, second only to Fruitvale – and this is comparing those communities’ 2011 rates to Castlegar’s 2012 rates.

Buss also pointed out that the tax bylaw is consistent with the budget and five-year plan already adopted by council.

“In order to craft the 2012 budget and 2012-2016 Five Year Financial Plan, city council held a series of budget meetings in January … and on January 31 … held an open house public meeting in order to receive suggestions, comments, and input into the budget from citizens of the community. Satisfied that the budget met the needs of the community, council adopted it as a bylaw on March 5.

“Presented in the financial plan was a 2012 municipal tax increase which equated to approximately $35 for the average residential property in Castlegar. “

For more information, contact City Hall at 250-365-7227.

Comments