By the numbers: RDCK to host public budget information sessions, in-person and online

For those looking to get a little more bang for their buck, the regional district is offering public budget meetings until the end of March.

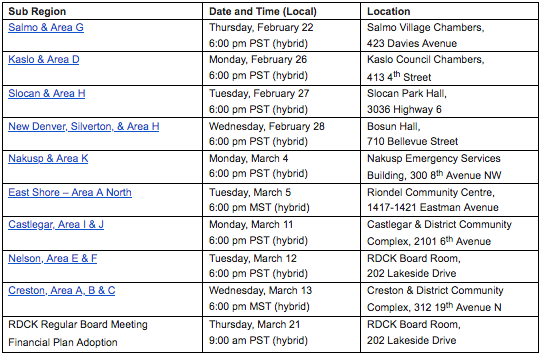

Continuing through to March 21, the Regional District of Central Kootenay (RDCK) will be hosting public budget information sessions for all its municipalities and electoral areas, including March 12 (6 p.m.) in Nelson for the city and electoral areas E and F.

As part of the meetings — offered in-person and online — RDCK staff will provide a breakdown of the regional district’s financial landscape and dissect the ingredients and development of the 2024-2028 RDCK Financial Plan.

“This is your opportunity to connect with RDCK directors and staff, ask questions, learn about the RDCK, and find out about projects and initiatives happening in your area,” said RDCK chief financial officer, Yev Malloff.

On Feb. 16 the board of directors reviewed a draft of the 2024-2028 Financial Plan, projecting an average increase on taxation of 9.3 per cent — down from 11 per cent after accounting for board revisions.

“This nets down to 7.9 per cent for RDCK property owners after non-market assessment growth is taken into consideration, although this is highly variable depending on the area or municipality the resident lives in,” said Malloff.

The increase is used to pay for over 180 services, also varying across the rural electoral and the member municipalities. The biggest change in taxation proposed for this year is in Area D, which could see a 17.7 per cent increase, followed by a 16.3 per cent increase for the Village of Salmo.

The city of Nelson’s 3.1 per cent average assessment increase is met with a proposed 12.2 per cent hike in taxation. In a similar vein, Castlegar’s 3.52 per cent assessment increase is paired with a projected 11.7 per cent taxation rise.

The $38.7 million the RDCK drew in its budget for 2023 has jumped to $42.99 in the draft plan for 2024. Although taxation could rise, on average, around 9.3 per cent, the BC Assessment for the entire RDCK has risen by only a 4.18 per cent average.

During the Jan. 19 special meeting, it was noted that inflation was the main culprit in driving taxation upwards, as well as some supply chain concerns, impacting several services and projects.

“Operational cost increases and required maintenance related capital projects in recreation, fire protection and resource recovery services are driving the bulk of the increases in taxation,” said Malloff. “Inflation and supply chain constraints also continue to have a cost impact across many services and projects, while higher interest rates are putting pressure on both short-term and long-term borrowing costs.”

The budget includes a Consumer Price Index increase on staff salaries and directors’ stipends of 6.2 per cent.

“RDCK staff are continuing to identify and implement opportunities to improve efficiencies of operations and administration to help temper inflation effects,” said Malloff.

See it to believe it

2024-2028 Draft Financial Plan

Comments